- Shop

- Computer

-

Electronics

- Accessories

- Audio

- Audio & Video Accessories

- Binoculars

- Binoculars, Microscopes & Telescopes

- Blu-ray

- Cables

- Calculators

- Camera & Photo

- Cell Phones & Accessories

- Chargers

- Charging & Power

- Clocks

- Computer Accessories & Peripherals

- Computer Components & Parts

- Computer Monitors

- Desktop Computers

- Drones

- Drones & Accessories

- Earbuds

- Fitness-trackers

- Gaming & Accessories

- Glasses

- GPS

- Headphones

- Home & Portable Audio

- Internet & Streaming

- Laptop Computers

- Microphones

- Microscopes

- Modems & Routers

- Ofice Phones

- Printers & Office Electronics

- Projectors

- Radios

- Remotes

- Restaurant Equipment

- Routers

- Scanners

- Shredders

- Smart Home

- Soundbars

- Speakers

- Subwoofers

- Tables & Accessories

- Telescopes

- TV & Video

- Watches

- Wearable Technology

- WiFi & Networking

- Gift Ideas

- Hidden Gems

-

Home

- Air Conditioners

- Air Purifier

- Benches

- Bookshelf

- Bookshelves

- Candles

- Carts

- Chairs

- Chandeliers

- Cleaning

- Cleaning Tools & Supplies

- Crafts

- Decor

- Dehumidifier

- Doorbells

- Fans

- Fireplace

- Fireplaces & Accessories

- Floor Care

- Funeral Products

- Furniture Accessories

- Generators

- Heaters

- Heating, Cooling & Air Quality

- Holiday

- Home Improvement

- Humidifiers

- Irons

- Lamps

- Laundering & Fabric Care

- Laundry

- Light Bulbs

- Lighting

- Lights

- Ottomans

- Party supplies

- Rugs

- Safes

- Safety

- Safety & Security

- Seating

- Sectionals

- Security

- Sewing

- Sewing & Craft Supplies

- Sofas

- Stools

- Storage

- Storage & Organization

- Storage Funiture

- Tables

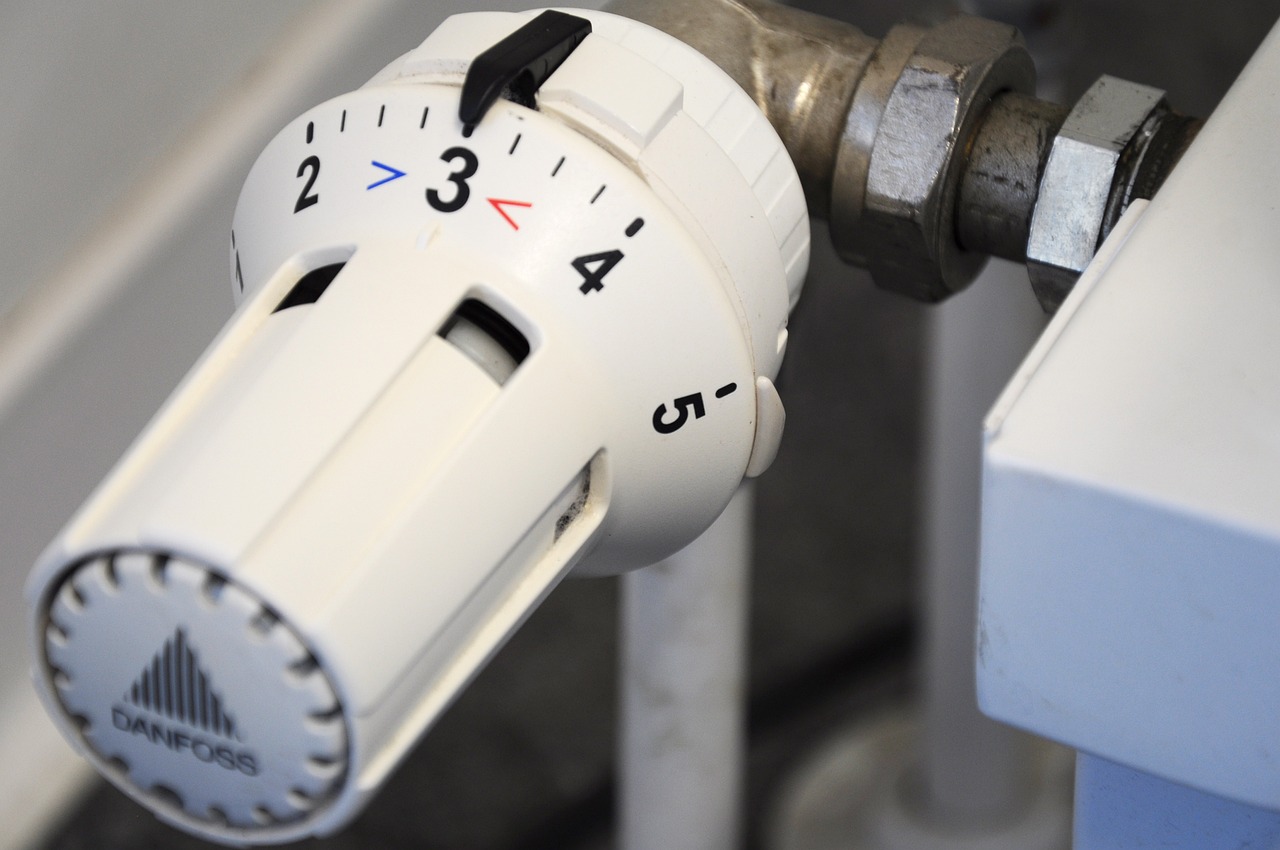

- Thermostats

- TV Stands

- Vacuums

- Windows

- Windows & Window Care

-

Kitchen

- Air Fryers

- Bakeware & Baking Tools

- Baking

- Bar & Wnie

- Blenders

- Blenders & Food Processors

- Bowls

- Coffee

- Coffee & Accessories

- Cookware

- Cookware & Cooking Sets

- Cookware & Cooking Tools

- Cutlery & Knife Accessories

- Deep Fryers

- Electric Grills, Griddles & Skillets

- Entertaining

- Food

- Food Processors

- Fryers

- Grills

- Grinders

- Grocery

- Hand & Stand Mixers

- Ice Cream Makers

- Instant Pot

- Juicers

- Knives

- low Cookers

- Lunch Boxes

- Microwaves

- Mixers

- Mixing Bowls

- Pressure & Slow Cookers

- Rice Cookers

- Scales

- Scales & Thermometers

- Sinks

- Sinks & Hardware

- Small Appliances

- Specialty

- Storage

- Tea Equipment

- Tea Makers

- Thermometers

- Toaster Ovens

- Toasters

- Toasters & Toaster Ovens

- Tools

- Trash Cans

- Trash Cans & Recycling Bins

- Utensils

- Utensils & Gadgets

- Utensils & Tools

- Waffle Makers

- Water Containers & Accessories

- Water Filters

- Water Purifiers

-

Lawn & Garden

- Beekeeping

- Beekeeping & Feeders

- Decor

- Decorations

- Edgers

- Feeders

- Fences

- Fending

- Fertilizers

- Flowers & Plants

- Gardening

- Greenhouses

- Hedge Trimmers

- Indoor Gardening

- Insect & Pest Control

- Irrigation

- Lawn Care

- Lawn Mowers

- Leaf Blowers

- Outdoor Power Equipment

- Pest Control

- Plant Care

- Pressure Washers

- Pruning Shears

- Rakes

- Sheds

- Shovels

- Tillers

- Tools

- Watering & Irrigation

- New Discoveries

- By Automatically Hierarchic Categories in Menu Extra|Extra Child

- Deals

- Gift Ideas

- Lifestyle

- New Discoveries

-

Featured

-

Featured

- Recent

-

Select Page