Proper right here’s a real story. Upon scripting this piece, I tried to organize a PPC advertising and marketing marketing campaign on a whim and no longer the usage of a plan or clue (coaching on my good friend’s small business—oops). I merely set the finances and let it run. Was once as soon as it good? I’ll cross away it up to you.

So, I consulted with a lot of PPC execs and watched a dozen webinars to provide you with smart and strong stuff.

You’ll to find seven tactics for managing your PPC finances and 5 pointers for making smart adjustments.

Let’s dive correct in.

Table of Contents

What’s a PPC finances?

A PPC (pay-per-click) finances is the amount of money you plan to spend on ads where you pay each and every time someone clicks on them.

A few words you’ll run into proper right here:

- Daily finances – How so much you spend every day. Advertisements prevent showing until tomorrow in the event you prevail on this limit.

- Advertising and marketing marketing campaign finances – All the amount you wish to have to spend on a selected ad advertising and marketing marketing campaign.

- Bid amount – How so much you pay for each and every click on on in your ad. Higher bids can get your ad confirmed further then again price further.

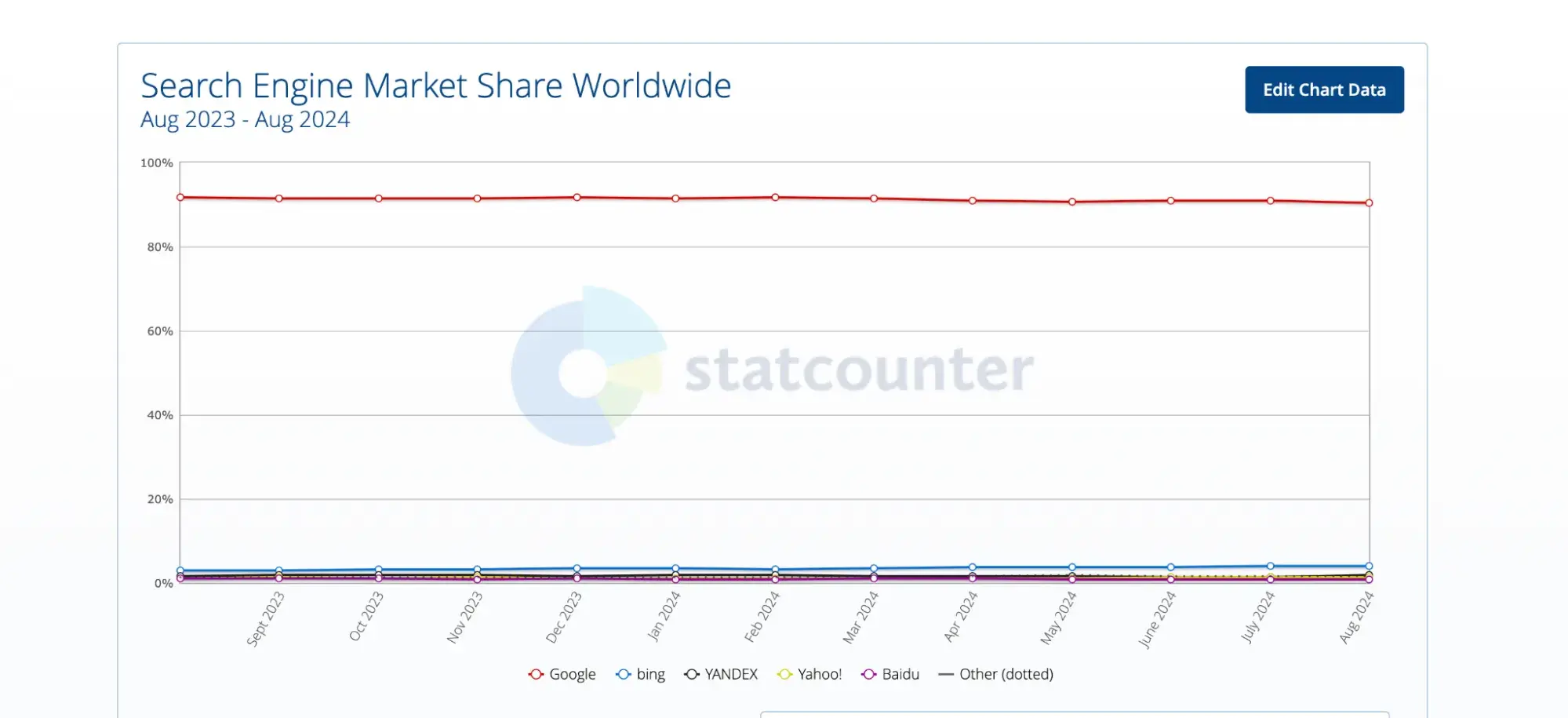

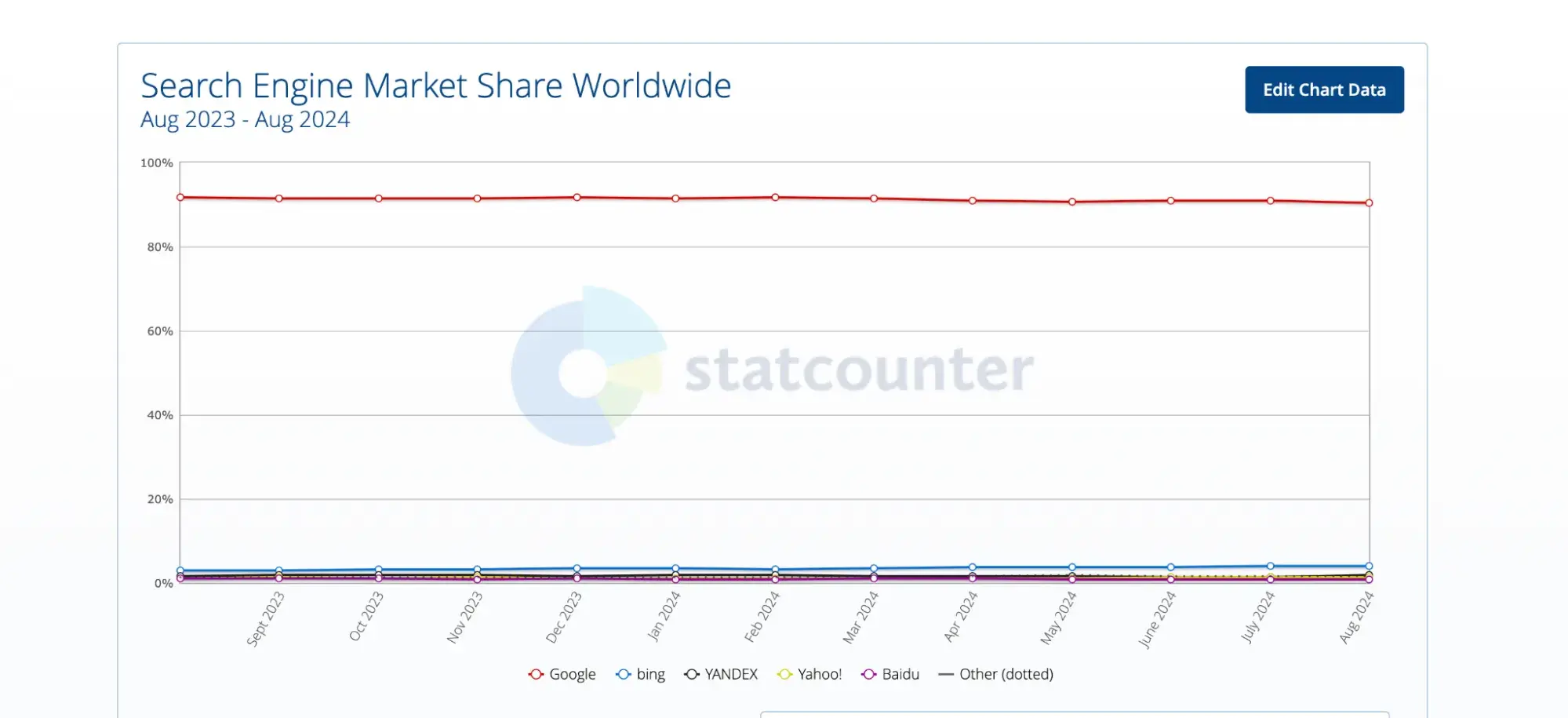

Previous than putting in a PPC advertising and marketing marketing campaign, think about where your audience is most full of life.

For example, if your audience uses Facebook more than X, spend further of your finances on Facebook. Do some research to ensure your ad spend goes to the most productive channels.

Usually, prioritize Google PPC first, as Google has 90.48% of the worldwide seek engine marketplace.

Symbol Supply

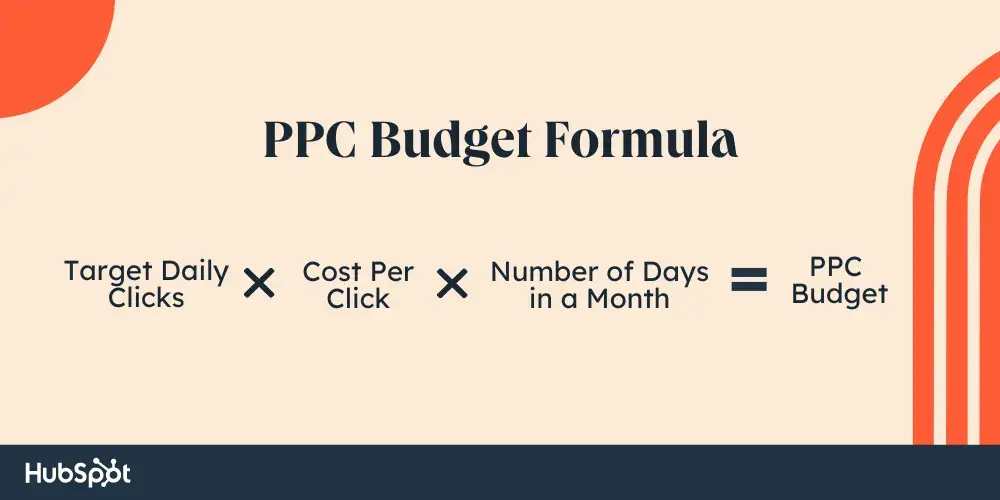

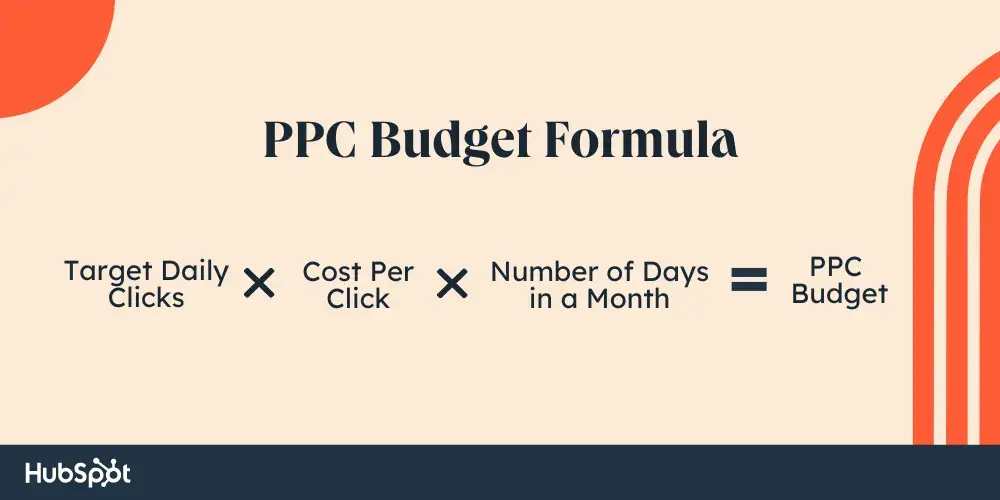

What’s the PPC finances gadget?

From my chats with a lot of PPC experts, most of them rely on the program:

Where:

- Function daily clicks: What selection of clicks you wish to have to reach every day. It’s made up our minds via your advertising and marketing marketing campaign objectives and the predicted guests.

- Worth in line with click on on (CPC): The typical amount you’re prepared to pay for each and every click on on. Estimate it in keeping with historical data or business benchmarks.

- Number of days in a month: Most often 30 or 31 days, then again you’ll regulate it for the precise month or advertising and marketing marketing campaign duration.

Example Calculation

Let’s say:

- You wish to have to reach 50 clicks in line with day.

- Your reasonable Worth In step with Click on on is $2.

- You could be budgeting for a month with 30 days.

Now, let’s put into effect the gadget:

50 clicks/day &instances; $2 in line with click on on &instances; 30 days= 50 &instances; 2 &instances; 30 = 3000

So, your per thirty days PPC finances may also be $3,000.

Calculate Your PPC Finances

To calculate your PPC finances, you merely wish to phrase down a few formula and also you’ll wish to do the entire thing in this order:

1. Understand your purpose CAC.

Previous than you bounce into the calculation, understand your CAC—the full price to get a brand spanking new purchaser. Roughly, it’s all your promoting and advertising and marketing and product sales costs divided by the use of the choice of new customers.

For example, in the event you spend $10,000 on promoting and advertising and marketing in a month and succeed in 100 new customers, your CAC is $100.

“I always get began with the target price to procure a purchaser or CAC. In case you don’t know that amount, calculate one in keeping with the standard purchaser lifetime worth and make a decision how so much you’ll afford to spend on selling while maintaining a healthy receive advantages margin,” says Brooke Webber, head of selling at Ninja Patches.

2. Calculate daily finances.

Daily budgeting helps in allocating worth vary to different days of the week in keeping with potency patterns. As an example, likelihood is that you’ll to find that weekends generate further conversions, allowing you to allocate further finances at the ones days.

Ed Stapleton from Clicks Geek suggests multiplying the typical click on value by means of 5.

So, if the press price is $10, then $10 x 5 = $50. This $50 is your prompt minimum daily ad finances.

“I profit from this multiplier because of most campaigns convert between 20% to 40% on the landing internet web page. This means kind of 2 to 4 out of 10 clicks become leads. To be secure, I profit from a multiplier of five to you should definitely get a minimum of one lead in line with day,” says Stapleton.

3. Calculate weekly finances.

After calculating the daily finances, you’ll switch forward to calculating the weekly costs. Ed advises multiplying the daily finances by the use of the choice of days you plan to run your ads each and every week.

If the daily finances is $50 and likewise you run ads 5 days every week, the weekly finances may also be $250 ($50 x 5).

4. Calculate per thirty days finances.

Finally, to calculate the per thirty days finances, multiply the weekly finances by the use of 4 to get a elementary per thirty days finances. However, Ed notes that for a further proper estimate, likelihood is that you’ll use 4.3 weeks to account for variations inside the choice of weeks per month.

For example, with a weekly finances of $250, the per thirty days finances may also be $1,000 ($250 x 4) or $1,075 ($250 x 4.3).

Proper right here’s a breakdown for all 3 calculations:

Daily Finances:

Avg CPC x 5

Daily finances x 5 = weekly finances

Weekly finances x 4 weeks = per thirty days finances

Example:

Avg CPC is $10

$10 x 5 = $50

$50 x 5 = $250

$250 x 4 = $1,000

$1,000 is the per thirty days ad finances

Organize Your PPC Finances

Turns out that 72% of businesses haven’t reviewed their advert campaigns in over a month, which is surely now not easy methods to organize your PPC marketing campaign and its finances.

Symbol Supply

Proper right here’s how correct PPC finances regulate must look:

Determine a check out finances to grasp key metrics.

Allocate a small portion of your normal PPC finances as a “check out amount.” It is a low-risk technique to try different strategies without spending a lot of money.

I got this golden nugget from Jim Kreinbrink, CEO of Hyper Canine Media.

“Our preliminary finances method often starts with a ‘check out amount,’ which we deploy and analyze to grasp key metric averages akin to price in line with click on on and conversion fees. The ones insights then lend a hand us to forge a further an expert and result-oriented finances,” Kreinbrink says.

Make a decision the optimal finances.

After a short lived testing segment, it’s time to jump into the actual issue.

I spoke with Nick Drewe, founder and CEO at Wethrift, who outlined that at this stage, you need to consider the whole promoting and advertising and marketing finances, business benchmark data, and the desired CPA.

He recommends starting with a smaller finances and regularly increasing it as you begin to see a excellent ROI. More recent firms would possibly to find allocating spherical 5-10% of their gross source of revenue to PPC to be a good starting point.

Michael Nemeroff, co-founder & CEO at RushOrderTees, shared his take on this, too. He says you’ll’t calculate an exact finances, then again you’ll get gorgeous close and regulate as potency metrics are to be had in:

“I take a look on the website’s normal conversion worth and think the PPC advertising and marketing marketing campaign can be relatively lower. So, if internet web page conversion is 8%, I would possibly think the promoting marketing campaign’s conversions are at 5%,” Nemeroff says. “Then, I take a look on the standard CPC in Google’s keyword planner and forecast different budgets.”

Nemeroff explains with an example.

“If the standard CPC is $10, $1,000 per month yields spherical 100 clicks and, conservatively, 5 leads. In case you spend $2K, that means 200 clicks and 10 leads, and so on. You forecast different scenarios, make a decision what selection of new shoppers or product sales you’ll moderately care for, and set your finances as it should be,” Nemeroff says.

Run ads for every week to make a decision CPC.

I moreover talked to Brandy Hastings from SmartSites, who prompt me that some of the best approaches is operating ads for every week to get a clear symbol of your CPC.

She problems out, “Bear in mind the price in line with click on on, and then set the inexpensive to earn a minimum of 150-200 clicks. Use that method for the principle month to get a in reality really feel for {the marketplace}, adapting to the patterns that start to emerge.”

This will give you enough data to seem how your CPC is trending. After the week is up, review the consequences to grasp your reasonable CPC and regulate your finances and bids as sought after.

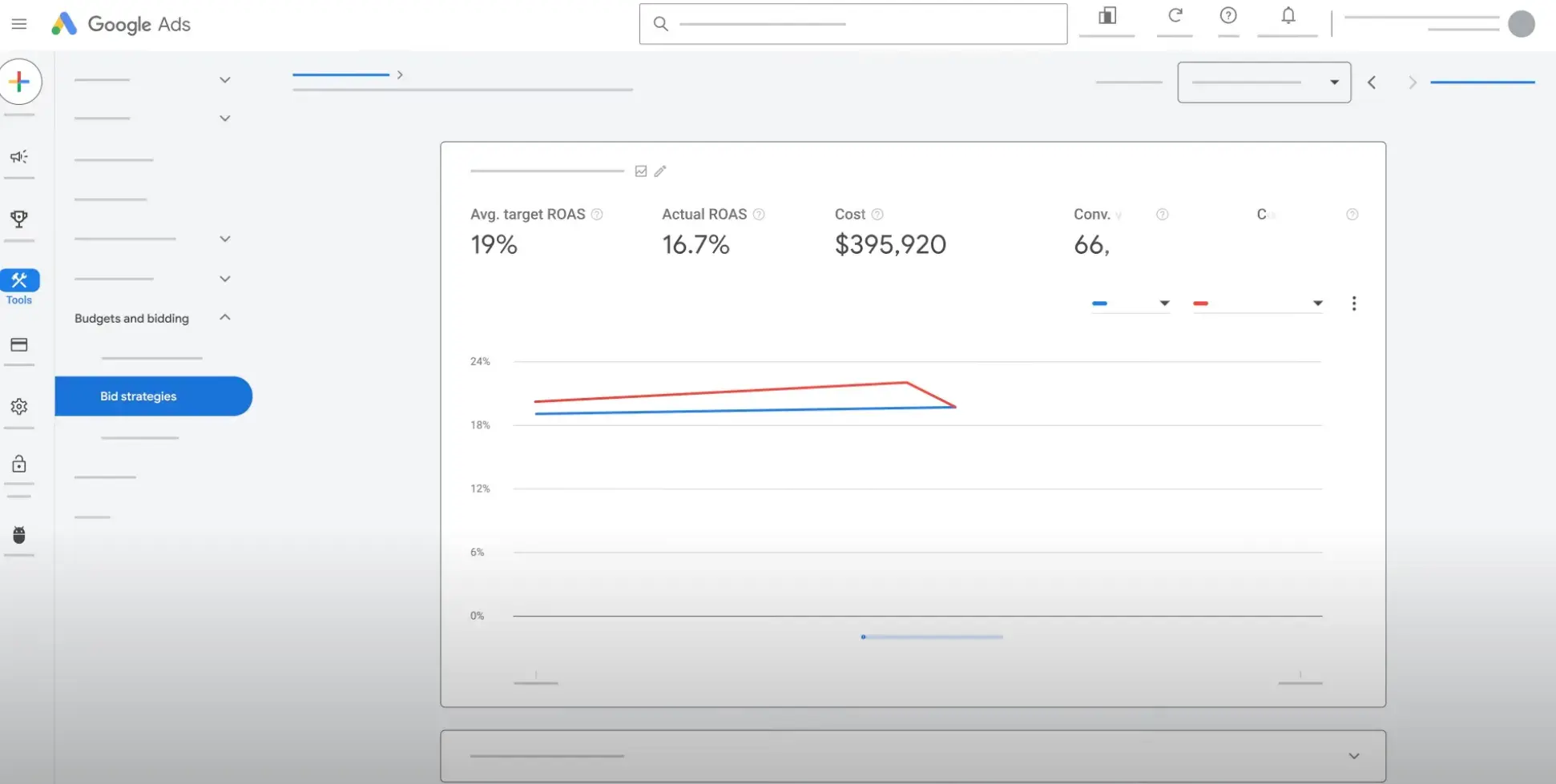

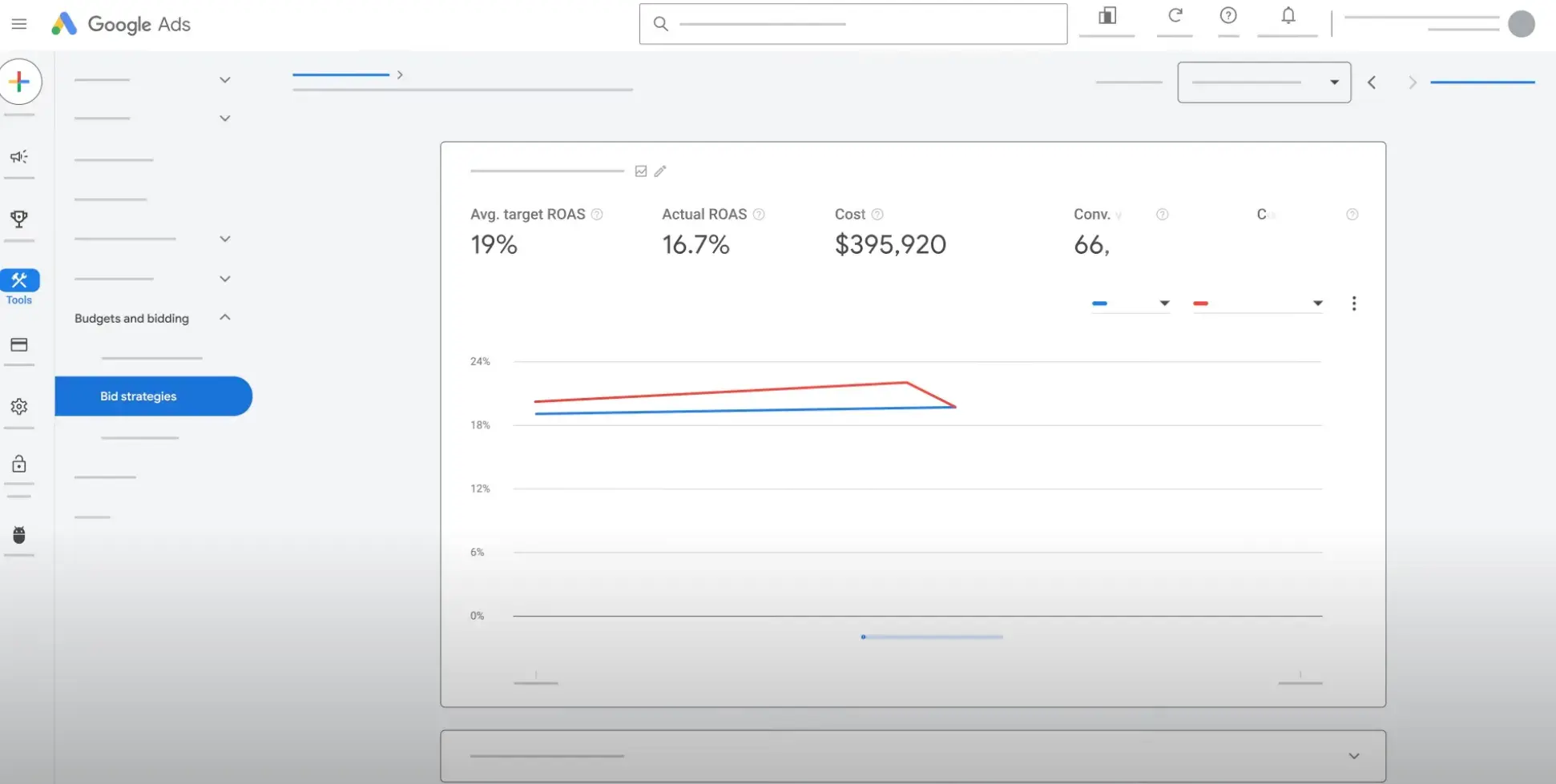

Use Google Just right Bidding.

Many experts recommend the use of Google Just right Bidding to optimize ad spend and boost PPC results.

Symbol Supply

Proper right here’s how it works:

- It uses refined algorithms to analyze tons of information and predicts how different bids will impact conversions.

- It parts in indicators like software, location, and time of day right through each and every auction.

- You’ll be capable of set explicit objectives like maximizing conversions or hitting a purpose CPA. Just right Bidding adjusts your bids to fulfill the ones targets effectively.

- Detailed tales show exactly how your bidding strategies are showing and what to give a boost to.

Use a layered finances methodology.

A layered finances methodology is a method of allocating your PPC finances all the way through more than a few types of campaigns to steadiness potency and experimentation.

It’s some of the best methods for managing the PPC finances, in step with Jeffrey Zhou, CEO at Fig Tech.

“We put into effect a ‘layered finances’ methodology that prioritizes results and experimentation. We spend 60% on high-performing ads with strong returns, 30% on new campaigns or ad formats, and 10% on experimental duties,” says Zhou.

Zhou says that this segmentation saved his group of workers from huge risks.

For example, when they presented a newly developed supplier, they spent 30% of their finances on testing video ads, which finally outperformed static ads, prompting them to allocate additional resources to video.

Refine your audience by way of micro-targeting.

“As an alternative of vast that specialize in, use micro-segmentation to direct ad spend against extraordinarily explicit purchaser profiles,” continues Zhou.

When his group of workers began the use of location-based that specialize in together with income data, they spotted a 25% increase in conversions while maintaining the equivalent finances.

To put into effect micro-targeting, define your audience first:

- Demographics: Function by the use of age, gender, income, coaching, and task.

- Geographics: Focal point on explicit cities, neighborhoods, or areas.

- Behavioral data: Use browsing history and purchase behavior.

- Interests: Tailor ads to shoppers’ spare time activities and preferences.

Then switch to sophisticated choices, comparable to:

- Custom designed audiences: Function your present customers or website visitors.

- Lookalike audiences: To find new shoppers similar to your provide customers.

- Retargeting: Re-engage shoppers who’ve interacted together with your brand then again haven’t reworked.

Damage down your finances by the use of keyword potency.

Focal point finances on top-performing keywords to give a boost to normal advertising and marketing marketing campaign potency—higher CTR and reduce CPA. This leads to upper visibility and more effective that specialize in.

Shawn Plummer, CEO at The Annuity Knowledgeable, says that he had good fortune spending 20-30% of all the finances on high-converting, reasonable keywords, which very a lot greater lead rely without incurring additional costs.

“After I allocated a greater amount of our finances to branded search phrases, we witnessed a 40% decrease in price in line with lead, boosting normal efficiency”, says Plummer.

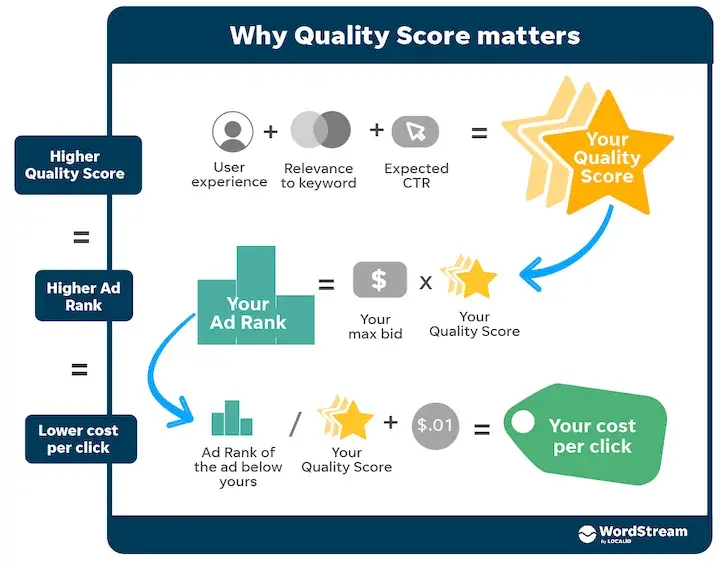

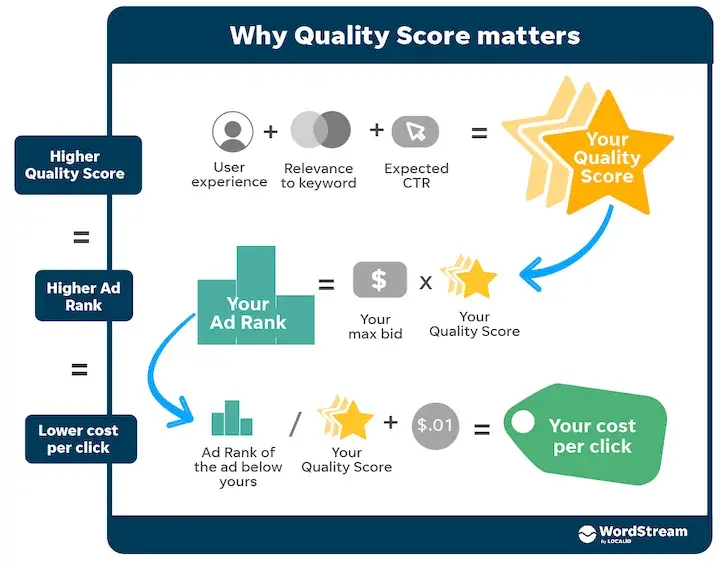

Continuously review prime quality rankings to gauge keyword effectiveness.

In Google Advertisements, you’ll to find it beneath “Top quality Rankings,” which reflect the relevance of your keywords, ads, and landing pages. Top quality rankings lead to lower CPC and better ad placement.

Symbol Supply

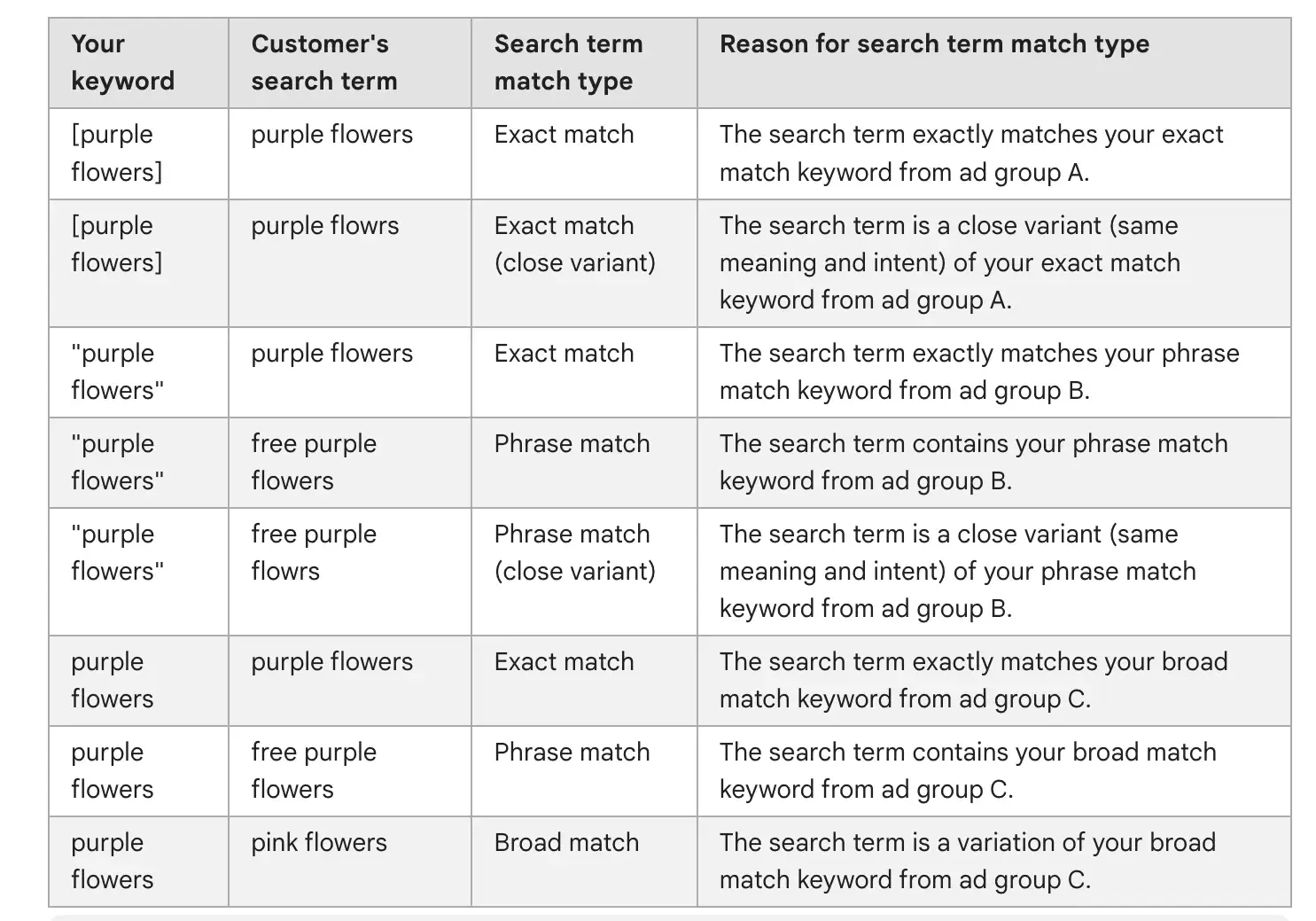

Moreover, in Google Advertisements, use the Search Words File to seem the actual queries that caused your ads. It’ll can help you see if your ads are confirmed for comparable searches and decide high-performing or inappropriate search words.

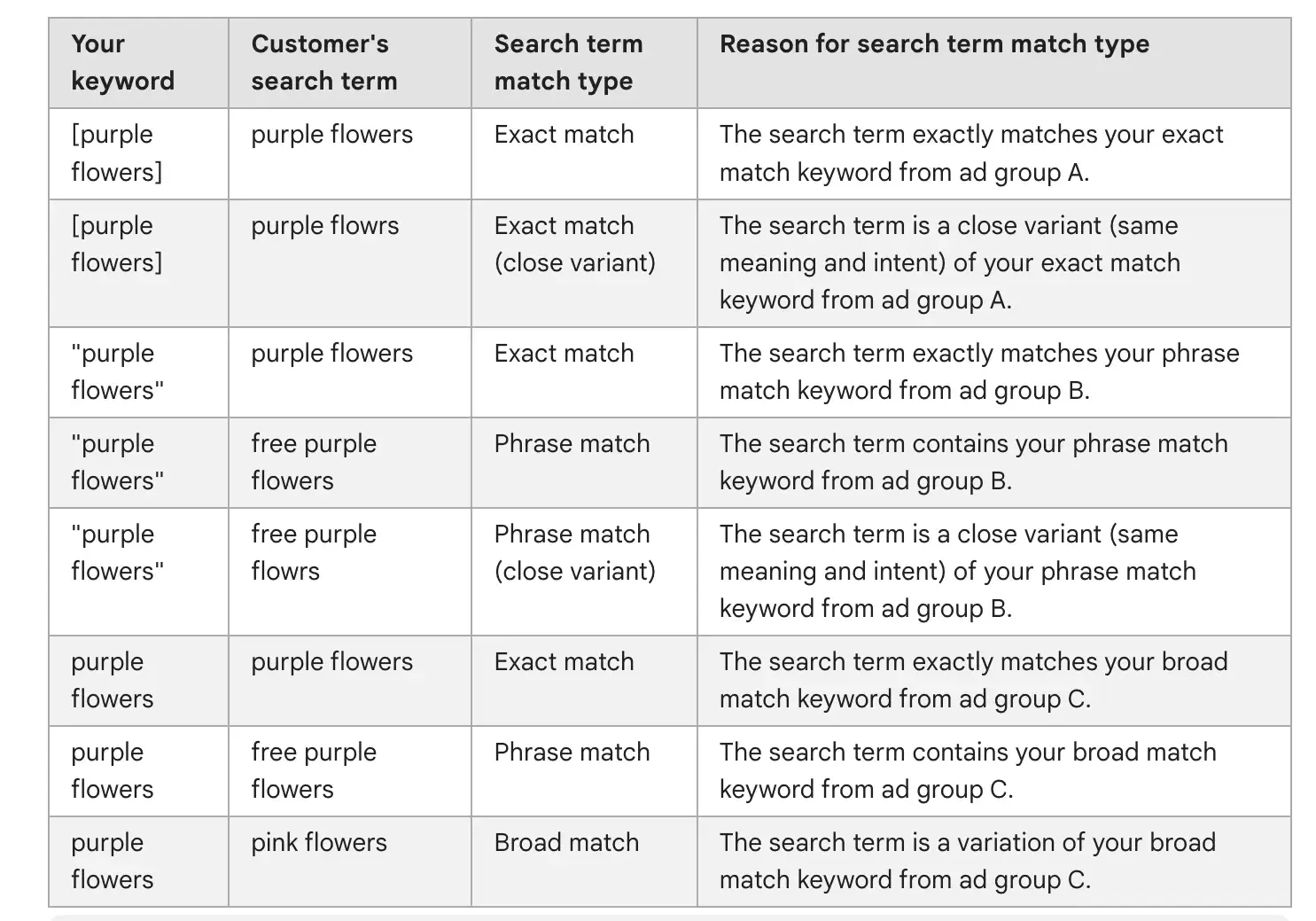

Here’s a simple breakdown to make it clearer:

Keyword vs. search time frame:

- Search Time frame: The real words folks type into the hunt box.

- Keyword: The words you select in your Google Advertisements advertising and marketing marketing campaign to concentrate on those searches.

Have compatibility varieties: Indicates how carefully the hunt words suit your keywords:

- Actual Have compatibility: The suitable search time frame fits your keyword.

- Phrase Have compatibility: The search time frame comprises your keyword.

- Massive Have compatibility: The search time frame is a variation of your keyword.

Symbol Supply

5 PPC Budgeting Tips from Execs

And now for the cherry on top—5 juicy an expert pointers that can assist you plan and allocate your finances upper:

1. Not unusual potency evaluations and reallocation.

Not unusual evaluations can help you spot characteristics and shifts in potency previous to they become vital issues.

Whilst you assess data incessantly, you’ll in short adapt to changes in ad potency or market necessities.

Shawn Plummer suggests the usage of weekly A/B testing to make a decision which ad creatives perform the most productive. Then, he reallocates up to 40% of the finances to those who outperform.

“Now not too way back, by the use of lowering spend on underperforming ads, we freed up worth vary to push ads with higher click-through fees, which boosted conversions by the use of 25% without raising normal spend,” Plummer says.

Casey Meraz, CEO of Juris Virtual, recommends endeavor tests a lot more incessantly—on a daily basis:

“Modify bids in keeping with the potency of more than a few keywords and ads. Profit from finances caps to avoid overspending. Continuously review and tweak your that specialize in requirements. This promises you get some of the out of each and every dollar spent while maintaining flexibility to shift resources as very important,” Meraz says.

Create custom designed, centered ad campaigns while tracking which ads convert prospects into customers with HubSpot Advertising and marketing Device.

2. Reverse engineer from CPA.

Dominic Taguinod, HubSpot’s PPC an expert, suggests reverse engineering from CPA as a smart methodology price attempting.

First, define how so much you might be prepared to spend to procure a purchaser. From there, you set a purpose CPC that aligns with this CPA goal.

This way helps you spend your ad finances effectively and acquire customers at a worth that works for your small business. In case you focus in your CPA first, you’ll upper allocate your finances and ROI and make further an expert adjustments.

Watch the whole video:

3. Don’t overspend or underspend.

Overspending can in short dissipate your finances and waste resources.

Underspending isn’t good each. It will finally end up in fewer clicks and conversions because of your ads aren’t attaining enough folks.

Chris Zangone from WebFX suggests always taking into consideration your marketing campaign’s ROAS (return on ad spend).

Spending more than you’re earning from your campaigns? Rethink your finances and optimization strategies as soon as conceivable.

Use the program:

Normal Source of revenue / Normal Worth = ROAS.

- Think your PPC advertising and marketing marketing campaign generated $10,000 in product sales.

- Suppose you spent $2,000 on the PPC ads.

- Use the ROAS Parts:

ROAS = $10,000 / $2,000 = 5

So, your ROAS is 5. On account of this for every dollar you spent on ads, you earned $5 in source of revenue.

In case you wanna dive deep into PPC finances regulate, save this super helpful instructional:

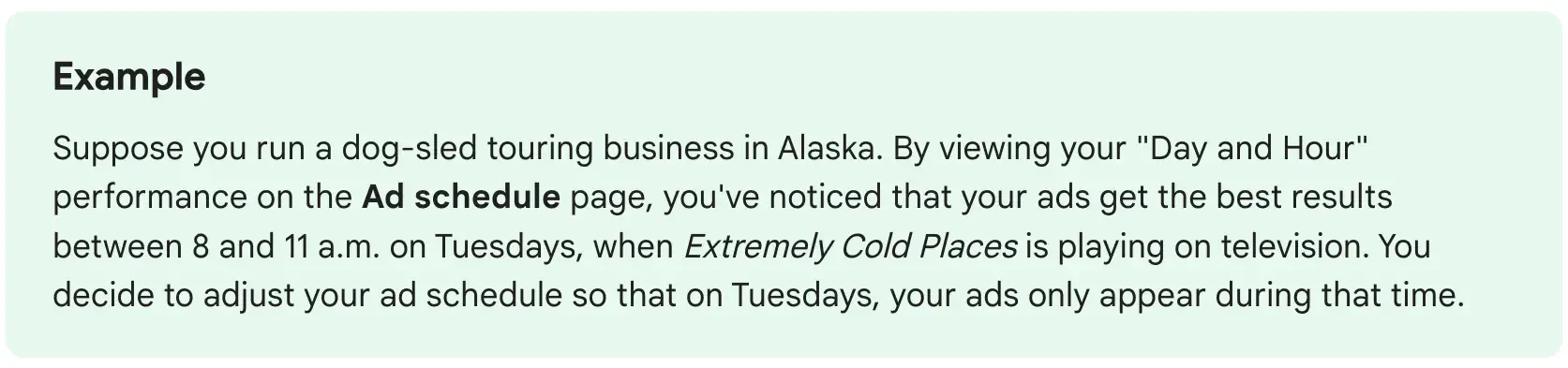

4. Leverage ad scheduling to cut waste.

Ad scheduling, or dayparting, signifies that you’ll regulate when the objective target audience will see your ads.

Run ads simplest right through cases when conversions are a lot more most likely to avoid wasting money on clicks that just about surely gained’t convert.

Jeffrey Zhou from Fig Tech says that many of their clicks were right through non-conversion hours. By way of running ads simplest right through top hours — like weekdays between 9 am and 6 pm — they improved their CPA by the use of 15% while maintaining guests prime quality.

Symbol Supply

5. Micro-budget testing for brand spanking new platforms.

Get began with small, controlled budgets when testing new selling platforms.

The use of micro-budgets and within data to be expecting conceivable ROI signifies that you’ll gauge effectiveness with minimal danger, in step with Debbie Moran, promoting and advertising and marketing manager at RecurPost.

As an alternative of rolling out a large finances on untested channels, Debbie’s group of workers started with micro-budgets and used their within machine-learning models to be expecting conceivable ROI previous to scaling.

With this way, they found out LinkedIn as an effective platform for that specialize in their B2B customers, where an initial $500 check out led to a 50% lower CPA than our usual channels.

Key Takeaways from PPC Professionals

Managing a PPC finances seems chaotic to begin with, then again if you happen to get the dangle of it, it in reality isn’t that bad. So, listed here are the three takeaways this non-PPC skilled (a.ok.a. me) has picked up as an important to wrapping up this knowledge:

- Get began small, check out, and be told. Kick problems off with a check out finances to get a in reality really feel for metrics like price in line with click on on and conversion fees.

- Make smart adjustments. Use apparatus like Google Just right Bidding to get some of the out of your finances. Stay on top of potency, and use micro-targeting to ensure your ads are hitting the right kind folks.

- Stay flexible. Continuously tweak your bids, budgets, and that specialize in in keeping with how problems are showing. Whether or not or no longer it’s checking in daily or operating backward from your purpose CPA, be adaptable to get the most productive conceivable ROI.

The overall piece of advice: Don’t dive into PPC haphazardly. Save this knowledge to walk you by way of each and every step and avoid skipping ahead, as missing even one step can lead to needless setbacks and, even worse—wasted money.

wordpress seo

[ continue ]

wordpress Maintenance Plans | wordpress hosting

read more